By: Beau Russell

FAYETTEVILLE, Ark (UATV) – When asked about plans to purchase homes, many University of Arkansas students found the idea unrealistic.

This is largely due to housing prices rising at a rate that far outpaces the rise of income. Since 1960, the average cost of owning a home in the United States (adjusted for inflation) has risen 118%, while the average income has only been increased by 15%.

The average income in 1980 at 30 years old was $23,600, with only $31,850 needed to afford a home. Today, the average income for a 30 year old is $68,700, but the amount needed to afford a home is $120,400. The home-price-to-income ratio has risen significantly.

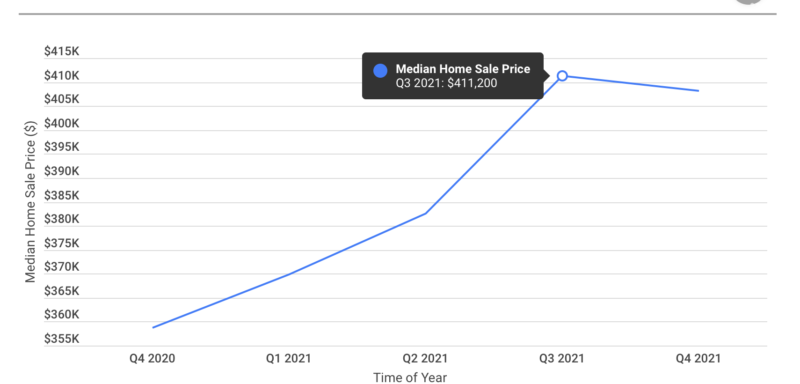

Not only has the price-to-income ratio risen, but the cost of owning a home is rising at a rapid pace. Between 2020 and 2021, the average price of a home sale rose from $358,000 to $411,000. Shockingly, since the year 2000, there are only 8 cities in the United States that have seen home prices increase less than 100%.

Along with rising home prices, college students and new graduates are also facing rising costs of living. The average cost of a dozen eggs in 2000 was $0.98 which contrasts drastically with today’s average cost of $4.21 per dozen eggs. The average monthly electric bill in 2000 was $75.01, in 2022 it was $132.16.

Americans aged 25-34 make up only 9% of home ownership, and that number could begin to decrease if wages don’t begin to more closely resemble costs.