By: Esther Gowin

FAYETTEVILLE, Ark. — As both of the top presidential candidates fought to gain support from young voters, the issue of student debt was debated across their platforms.

Thousands of students at the University of Arkansas face going into debt during their time in college.

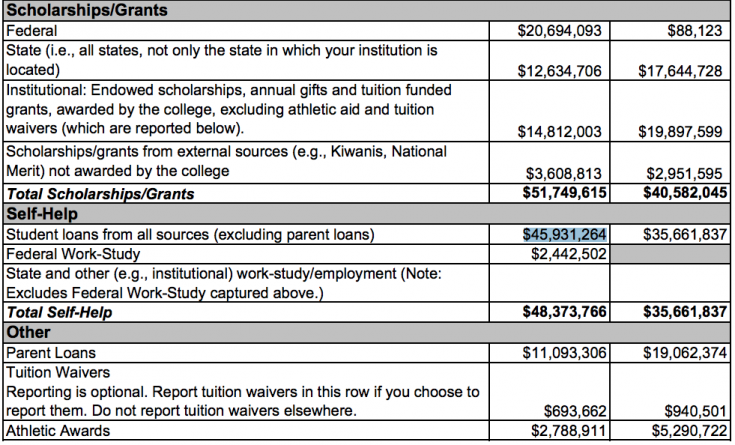

According to the U of A’s Common Data Set, undergraduate students are estimated to have taken out over $45 million in loans for the 2019-2020 year.

One student at the U of A, Elizabeth Strickland, said she has managed to avoid taking out loans for the past four years at college, however now she is faced with going into debt as she prepares for law school.

“I have never done it before and I am very overwhelmed by the process,” Strickland said. “I’m worried about what the future could hold in terms of accumulating debt over those three years.”

In response to the current pandemic, the Trump Administration suspended all federal loan interest until the end of 2020. President Trump has proposed a $25 billion loan forgiveness plan for the next stimulus bill.

During his campaigns for the 2020 General Election, Former Vice President Joe Biden proposed an up-front loan forgiveness plan that will forgive up to $10,000 of student loans for each student in higher-level education.

A political science professor at the U of A, Karen Seabold, said regardless of what candidates say they will do, voters should look at policies that directly affect them.

“It’s difficult to really get at what they are going to prioritize, who they are going to focus on,” Seabold said. “So, you have to go past what they are telling you and think about the parities that they represent.”

An associate researcher for economics at the Walton College of Business, Jeff Cooperstein, said disagreement about polices regarding student debt comes from figuring out where the funds would be allocated from in the economy.

“You can have too much of a good thing, that’s just basic economics,” Cooperstein said. “Marginal benefits of doing something good decline as you keep on doing more and more of it. Marginal costs go up because you are giving up something else.”

According to Seabold, the best way to ensure action is taken on an issue such as student debt, is to hold local representatives accountable after the election.